Project

From Tradition to Innovation: How an Omni-Channel Revamp Enhanced Insurance Purchase Efficiency

A leading Indian Insurance brokerage wanted to position themselves as an insurance advisory expert through an omni-channel presence.

As a team of UX researchers and consultants our objective was to map the end-to-end journey of retail insurance customers across offline and online channels. This would help understand their motivations, activities, expectations, feelings, delight and the hurdles in the path towards securing their loved ones and other valuable assets.

Key Details

Role

UX Researcher

Timeline

February 2022- May 2022

Methodology

1:1 Interviews

Competition Analysis

Insights reporting

Jobs to be Done

Co-creation

Team

4 UX researchers (including me)

Overview

Problem

Customers, especially first-time buyers, found it difficult to navigate the overwhelming sea of insurance options, often feeling lost and frustrated. This led to very few online purchases, as most relied on referrals for trusted offline agents from family members

The opportunity was clear: simplify the discovery, evaluation and purchase process so customers could effortlessly find the right insurance plan without the stress or lengthy wait for recommendations.

Outcome

An in-depth analysis of the current state purchase journey for different types of insurances with specific recommendations for each stage of the journey.

This was supported by a co-created, future state journey map with the client team (under NDA).

Customer Research

Customer research findings

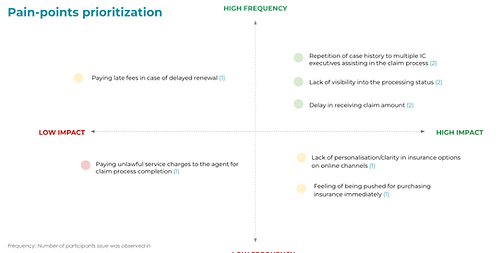

Since this was a qualitative research project, we conducted 70+ 1:1 interviews with first time and experienced customers. Below were some key findings:

01

First time buyers lack understanding on how to start finding insurance products that are aligned to their personal security and financial goals.

02

Given the pool of insurance providers available across online channels, customers lack the desired personalization, making the evaluation process lengthy and confusing.

03

Those unsuccessful in finding insurance products online, wait for getting trusted references from their social circle for buying it quickly offline from agents.

04

Even after purchasing the insurance product, customers do not get timely insights and resolution for their claims when they file for the same.

Customer feelings journey

The buyer's emotional roller coaster

With the above mentioned pain points and findings, we also observed buyers going through an inconsistent, varying range of feelings as they traversed through the purchase journey.

We illustrated this as shown below to get an exact understanding of where the extreme points of frustration existed.

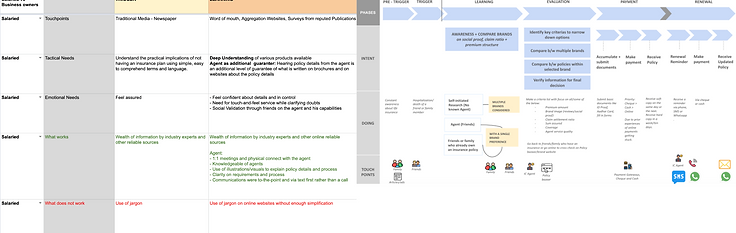

The Customer Journey Maps

Mapping the detailed customer purchase journey

Need for Co-Creation

Finding solutions together by leveraging roadblocks

During our research, we uncovered critical nuances about the customer experience that our internal team struggled to address due to a lack of subject matter expertise. We recognized that our team, while skilled, lacked the deep industry expertise necessary to fully address these complexities.

Further, the complexity of catering to diverse customer needs, spanning both urban tier-1 cities and semi-urban tier-2 and tier-3 areas made us realize that our internal ideation alone couldn’t address these multifaceted challenges.

Realizing the depth of these challenges, we pivoted to co-creation. By collaborating with client stakeholders and industry experts, we tapped into the essential knowledge and insights needed to address these nuances effectively.

6 lenses to ideate with

Basis the key touchpoints and opportunity areas identified from the research findings, we outlined 6 lenses that would be used to ideate upon through a co-creation workshop with insurance experts and digital marketing agencies who work with them.

This would help ensure diversity of ideas as well as assuring all opportunity areas are brainstormed for by experts who know what is feasible and scalable in the real market.

Storyboarding

Basis the top voted idea for each lens, each team detailed it out through a visual storyboard to explain how the solution would work in a real-life user context.

Generating a wealth of ideas

We provided a framework called ‘Lotus Blossom’ to help teams come up with all possible pain points and opportunity areas for ideating. The starting broad topic/challenge is kept as the central box. Teams then add relevant themes or aspects of the topic to the 8 boxes surrounding the central box of the original challengein a 3x3 grid.

Once this was done, teams were told to come up with quick ideas for each sub-theme from the blossom. The idea was to generate as many ideas as possible.

Finally, all ideas were put on display on individual post-its- these were affinitied basis common themes and made open to all teams to start voting for the best ideas. The ideas with most number of stickers were taken ahead for further detailing.

Sharing out

Each storyboard was then presented to the larger team to get feedbacks and suggestions for modifications.

This also helped teams to pick up interesting and relevant solution bits and combine it with their solutions to form cross- collaborations across different departments within the insurance space

Lessons Learned

Reflecting on the project outcomes

01

Leadership = Compassion, Empathy and Flexibility

This was my first time leading a project, handling everything from client calls to team management and deadlines—a true crash course in leadership. What I learned quickly was that leading isn’t just about overseeing work; it’s about truly connecting with your team on a personal level. I realized the value of knowing each person beyond their tasks—understanding their work styles or whether someone thrived in the quiet of early mornings or hit their stride late at night.

It taught me that leadership is about more than just managing—it’s about creating a space where your team feels seen, valued, and able to do their best work, together.

02

The Power of Reflection

The key to this project’s success was our willingness to take a step back and honestly reflect on where we stood—what was working, what wasn’t, and where we needed to improve. It was in these moments of raw truth that we could make timely adjustments (PIVOTS in our case!) and keep things on track before any major setbacks occurred.

I realized that asking for help wasn’t about admitting weakness; it was about caring enough to get it right. It’s a show of accountability and a commitment to delivering the best possible work, knowing when to lean on others to fill the gaps.

03

Documentation + Over-communication is Key

I learned that documentation and over-communication were essential, especially since we weren’t onsite with the client. Keeping detailed records and sharing frequent updates kept everyone aligned and bridged the distance.

This approach gave the client visibility into our progress, reduced misunderstandings, and built trust. Over-communicating ensured clarity and kept collaboration smooth, making everyone feel connected and informed despite the remote setup.